Sales Return

A sold Item being returned is known as Sales Return. Businesses often return goods that are already sold.They could be returned by the customer due to quality issues,non-delivery on the agreed date,

Sales Return:

A sold Item being returned is known as Sales Return.

Businesses often return goods that are already sold.They could be returned by the customer due to quality issues,non-delivery on the agreed date,or any other reason.

1.Prerequisites:

Before creating and using a Sales Return,it is advised that you create the following first:

- Item

- Sales Invoice or Delivery Note

2.How to create a Sales Return:

- First open the original Sales Invoice / Delivery Note,against which the customer returned the Items.

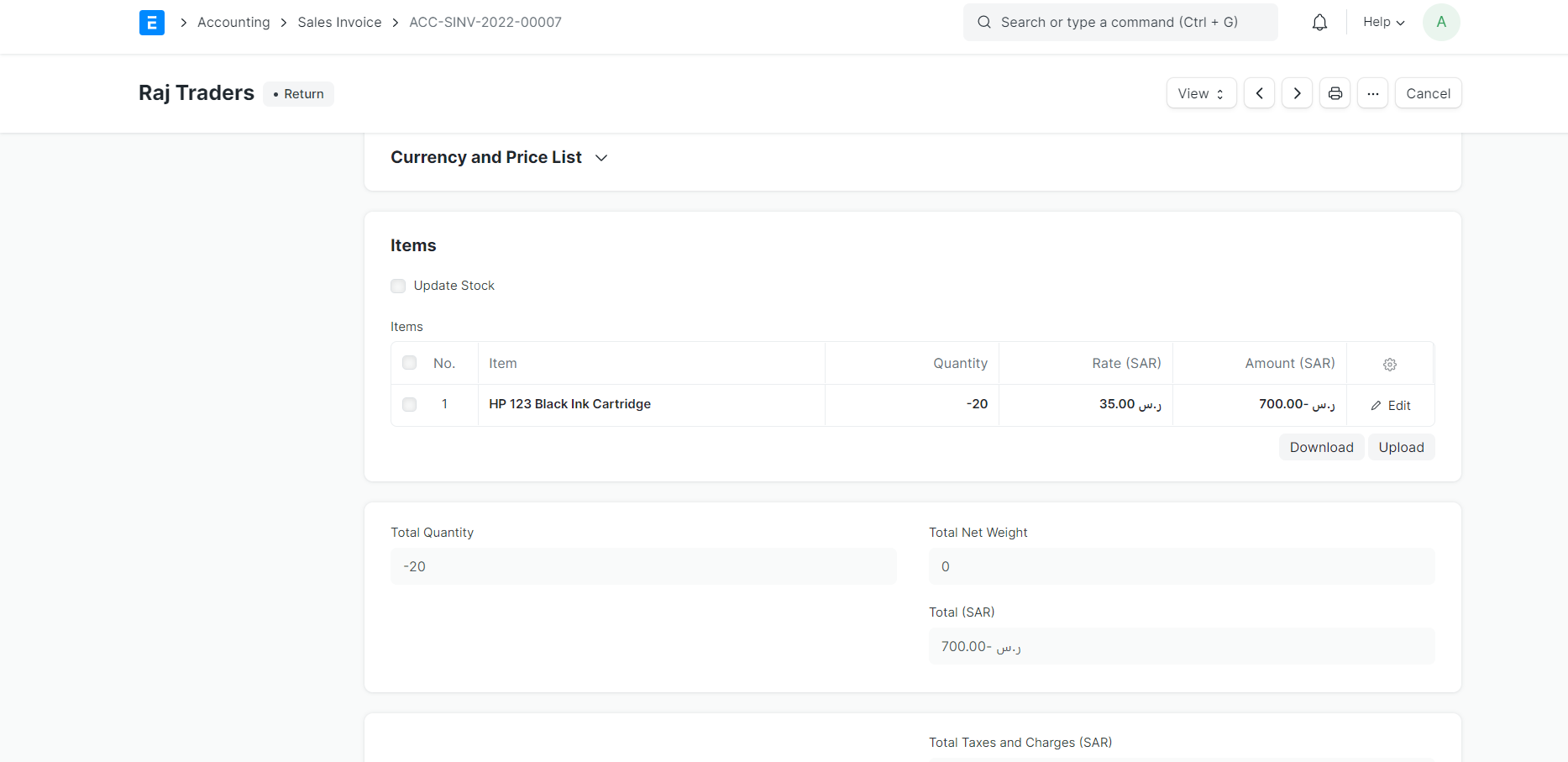

2-Then click on 'Create>Return/Credit Note',it will open a new Sales Invoice with 'Is Return(Credit Note)' checked,Items,Rate, and Taxes will be negative numbers.

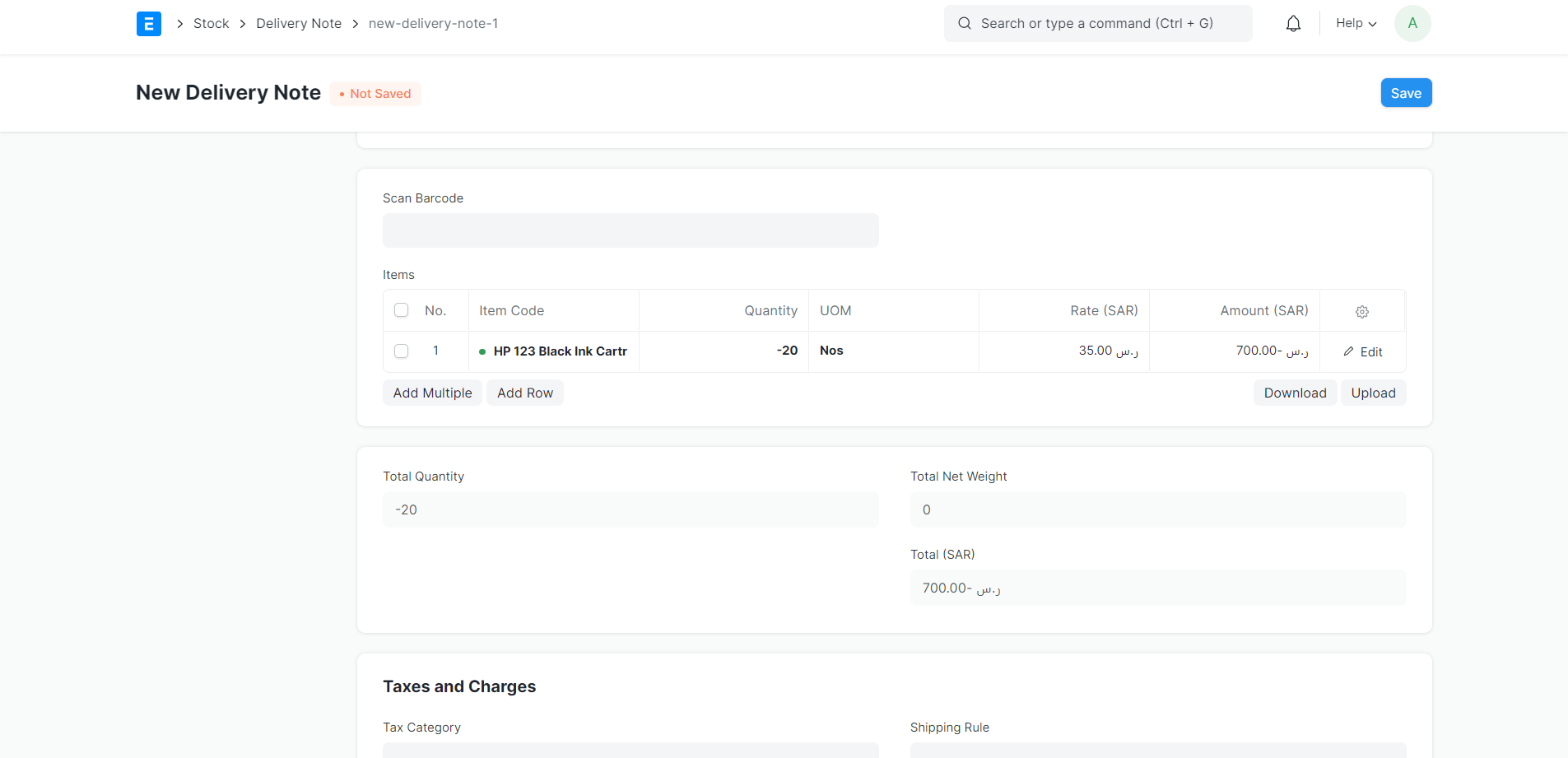

3-You can also create the return entry against Delivery Note.

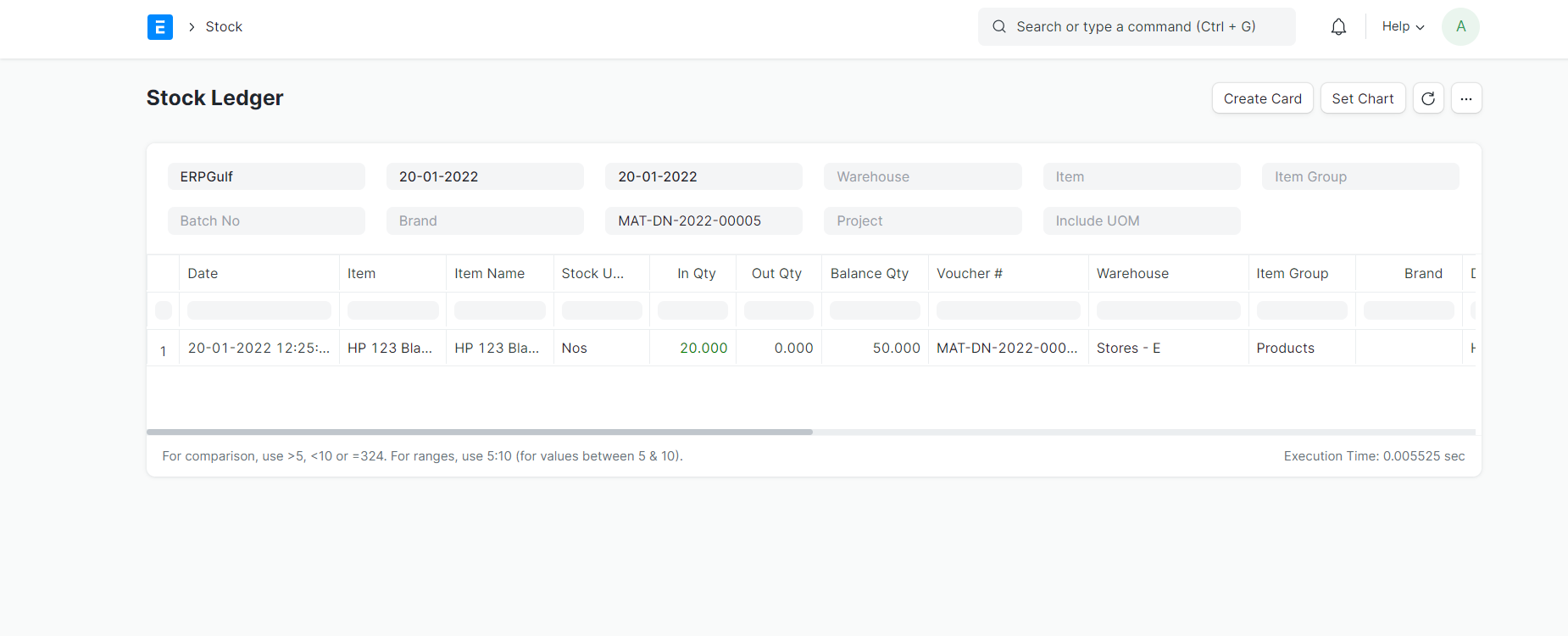

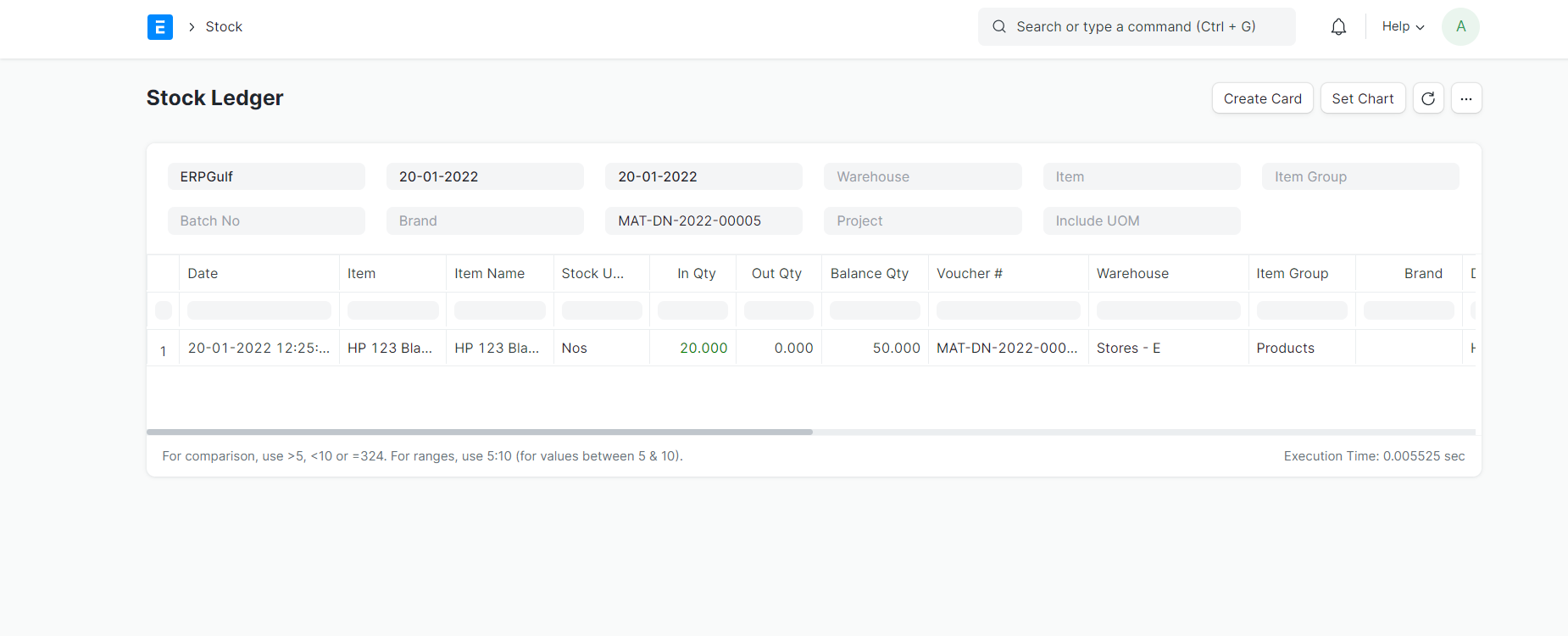

4-On submission of Return Delivery Note / Sales Invoice,the system will increase stock balance in the mentioned Warehouse.To maintain correct stock valuation,stock balance will

5- In case of Return Sales Invoice,Customer account will be credited and associated income and tax account will be debited as shown in the Accounting Ledger.

- Example

R & T is a customer purchasing three items ,Stapler,Sticky Notes and Notepad.

Sales order,Sales Invoice,Payment entry and Delivery Note were created & submitted with these Items.After the items get delivered the customer wants to exchange Notepad to Box File.

In this Case you can create a return entry against the sales invoice and Delivery Note for Notepad and Create a new Sales Invoice and Delivery Note Against Box File.

Thahsin

Functional Consultant at ERPGulf

No comments yet. Login to start a new discussion Start a new discussion