ERPGulf ready for E-Invoicing in Saudi Arabia

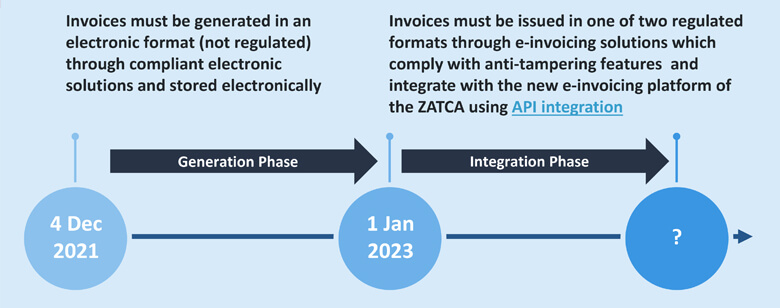

ERPGulf ready for E-Invoicing in Saudi Arabia Saudi Arabia to introduce E-Invoicing in two faces. Phase one - December 2021 Phase two - 1 January 2023

ZATCA - Tax and Customs Authority of Saudi Arabia announced two face implementation of E-Invoicing

e-invoices compulsory for B2B, B2G and B2C transactions, becoming effective in two phases:

- Phase one becomes effective on 4 December 2021

- Phase two is due to begin on 1 January 2023

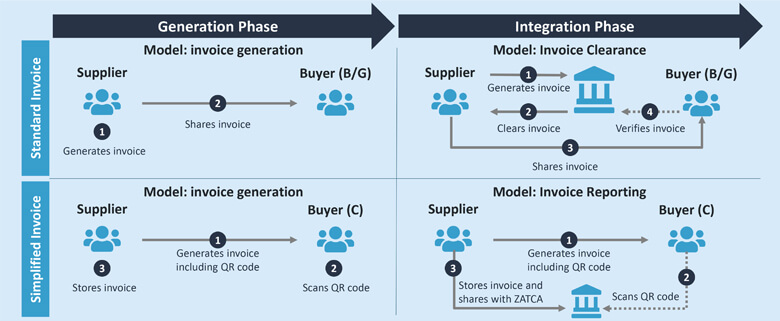

Phase 1 – the generation phase

Phase 1 of the e-invoicing legislation comes into effect on 4 December 2021. There will not yet be a central e-invoicing platform. Instead, the intention is that suppliers will move away from handwritten invoices and paper storage, and – of course – become prepared for Phase 2.

In phase 1, VAT-registered taxpayers need to

- generate invoices in an electronic format

- using an appropriate e-invoicing solution. This can be operated on-premises, in the cloud or in hybrid mode,

- store e-invoices electronically and

- send a copy of the invoice to the buyer.

During this phase, there are no specific stipulations on the electronic invoice format, as long as the content complies with the requirements of the standard invoice or simplified invoice. Simplified invoices for example, need to contain a Quick Response code (QR code), generated by the electronic e-invoicing system. QR codes enable consumers to scan in relevant invoice data using their mobile phones.

If you are just starting to introduce electronic invoices for Saudi Arabia, it would be prudent to implement one of the formats which will become mandatory in Phase 2.

The e-invoicing solution you use needs to fulfill certain security requirements, such as prohibiting uncontrolled user access or data manipulation, and making it impossible to reset the counter for sequential invoice numbering etc. However, at present it is unclear how and when the authorities might check and certify these anti-tamper measures.

Phase 2 – the integration phase

During the integration phase, your e-invoicing solution needs to be integrated with ZATCA’s new, central e-invoicing platform for Continuous Transaction Controls (CTC). There is a staggered start from 1 January 2023. Taxpayers affected by each stage will be notified six months in advance.

From phase 2 onwards

- Invoices must be issued in one of two stipulated formats

- Saudi Arabian XML invoice, which is based on UBL 2.1 syntax and the invoice definitions from EN 16931, but narrowed by Saudi Arabian requirements.

- PDF/A-3 invoice file with an embedded Saudi Arabian XML invoice (this is the same concept as ZUGFeRD in Germany and Factur-X in France, although the European examples use CII syntax while Saudi Arabia uses UBL syntax.)

- E-invoicing solutions must include certain anti-tampering features, such as a digital signature and a hash value as a universally unique identifier (UUID).

- Invoices need to go through ZATCA’s new e-Invoicing platform. This requires using API integration to connect your e-invoicing solution to the central platform.

The Kingdom of Saudi Arabia is following the global trend in compulsory CTC e-invoicing and e-reporting. It is introducing a new clearance platform by 2023. During the initial preparation phase, starting 4 December 2021, e-invoices need to be generated through compliant e-invoicing systems and stored electronically.

The second stage will be rolled out from 1 January 2023. In this phase, the new central e-invoicing platform will start to become mandatory for real-time e-Invoicing clearance and e-reporting.

The challenge is – as always – to consider and implement each country’s individual legal requirements

- without having to deal with several different local providers in the countries involved,

- while ensuring you meet the various technical requirements for inbound and outbound invoicing, such as stipulated data formats and communication channels,

- and simultaneously maintaining an easy and reliable connection to the respective ERP systems.

Electronic Invoice XML Implementation Standard to the E-Invoicing resolution dated 2021-05-28

Introductory guide to E-Invoicing in Saudi Arabia

Reference: https://blog.seeburger.com/mandatory-e-invoicing-in-saudi-arabia-to-be-phased-in-from-4th-december-2021/?utm_source=flipboard&utm_medium=flipboard_rss&utm_campaign=seeburger+blog

Contact us for E-Invoicing activation on your existing system at support@ERPGulf.com

Tech Reporter

Our team reports from all over the Gulf. Contact us on news@ERPGulf.com

No comments yet. Login to start a new discussion Start a new discussion